I have a confession to make. I have put this off as long as possible. I have skirted around this admission and have finally decided to own it. Today is the day to announce: I am a powerful woman. And, if I’m honest, I’ve always wanted to be one. I remember being young and just so angry. Angry at the way I was treated unfairly by my dance teachers, angry at my parents for controlling my every move because they were terrified of letting a Black girl loose in this world, angry at my classmates who didn’t seem to understand why I got into ivy league schools even though I had 2x amount of extracurriculars than them and also a better GPA. I was so angry so often and nobody seemed very interested in listening. The most grating (and most common) response I would get to my anger was laughter or some semblance of “isn’t she so cute”.

If I could just get them all to listen to me… I have such important things to say!

So, I devised plans in secret. I would work at a nonprofit for a while to get me closer to my dream of being in politics. Then I realized that those in power at my nonprofit were actually business people! So I decided to go into business. I got into business school, and looked around again. Who, I asked myself, is running stuff here? How do I get to actually have a say? I didn’t have to look far to find VCs. Once I got into the VC world, the question was again, what do I have to do to prove to people that I have something to say? That I have something to contribute? That my vision for the future of business is important?

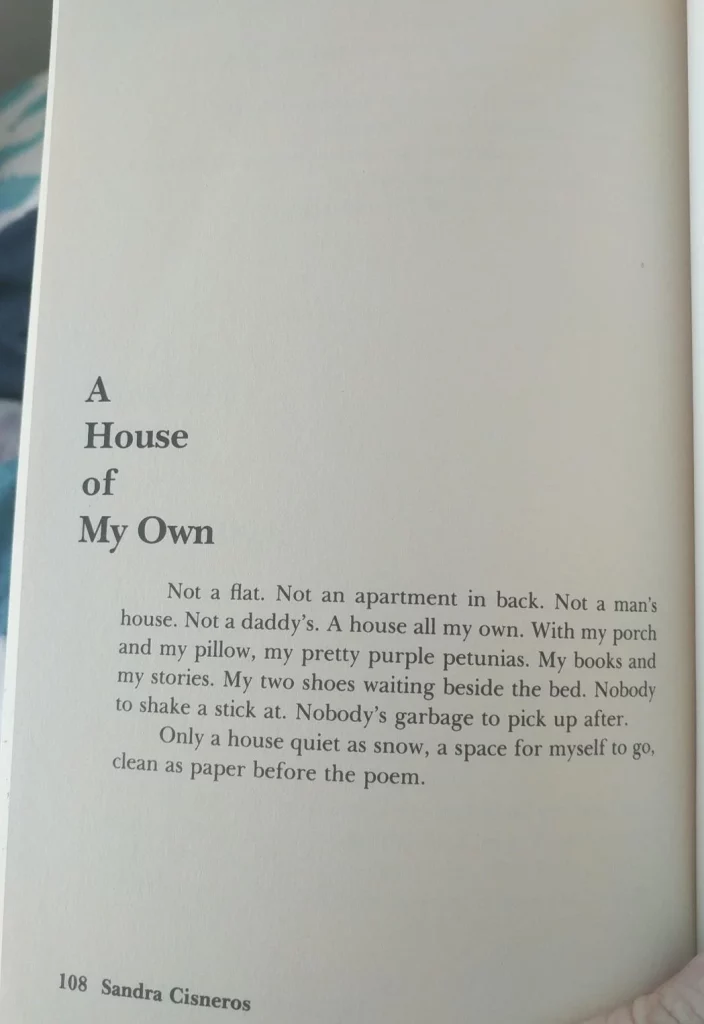

At the same time, I was also trying to figure out how would I start building wealth. I decided that real estate was the surest path. So I started negotiations early with my Berkeley landlord. After spending $50K+ in rent to him, he will sell me this duplex I’ve rented out for 5 years, right? Right?? Wrong. After this multi-year plan of mine died, I had to start from scratch. I found a house that I fell in love with in Oakland, and after two excruciating months, it was mine (well really it’s the bank’s for a few more decades, but for all intents and purposes, it is mine).

Now, I find myself with decision-making authority at a $100M+ fund, a house, a garden and honestly, a life I always dreamed of. I have more than enough.

Which means, by my own definition, I’m a woman with power. Because I have been so obsessed with this goal in mind, and so consumed by feeling like I didn’t have any, I have probably thought more about this topic than most. How do I honor the trust that people gave me to have this power? How do I not hoard the power I have? How do I create more space for more people to have more power?

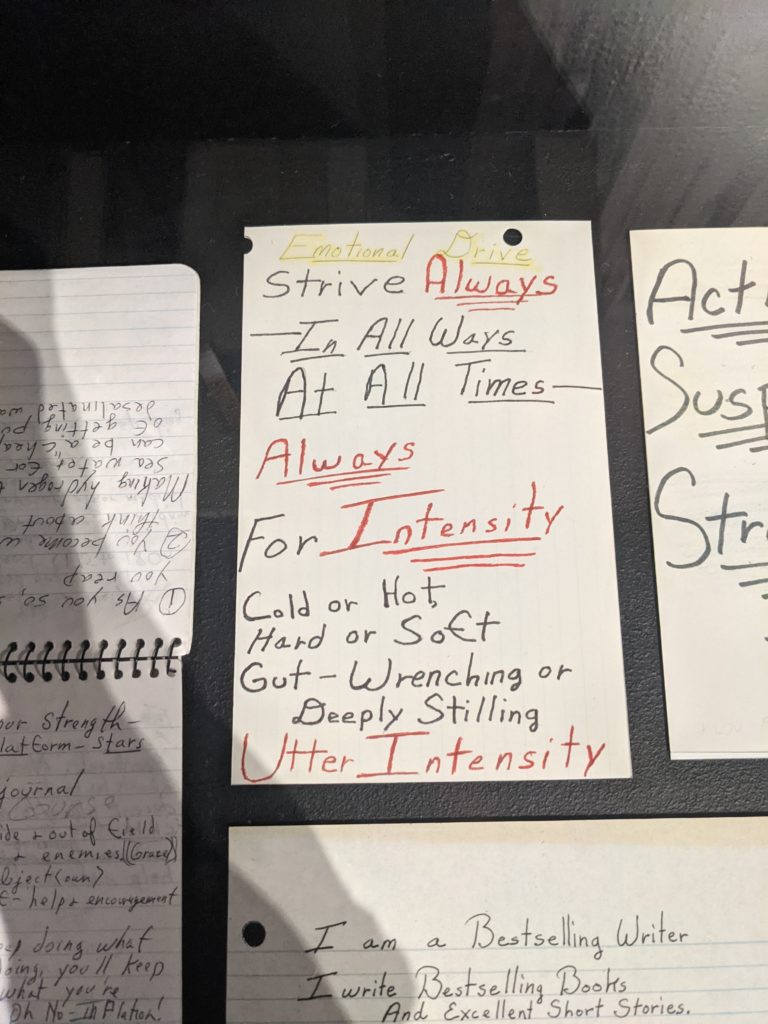

And because I am a woman who is so used to feeling powerless, I am not a woman with power who is fearless. I still have a lot of fear. I don’t think I have accomplished anything so far without feeling a healthy amount of fear.

This fear may stem from the fact that I have so many critiques for myself. Before anyone else has something to say about my own work or accomplishments to try to humble me, I have probably already said it to myself. So when I see other people who I think of as whole – not as mythical characters, but real people – and also in power get critiqued by others, I’m reminded of myself. I was and am that person who is critiquing, and I’m also the person in power. It’s a weird place to find yourself in.

I think of this book I’m reading – Cracking Up: Black Feminist Comedy. And so much importance is put on the audience. While the Black woman is on stage, making the jokes, the audience has the power to laugh or boo or be silent. This is particularly true at The Apollo – there was an awesome meditation on it in A Little Devil in America. When we acknowledge that our power is only – as Brene Brown put it – power with instead of power over, who do we become? How do we facilitate meaningful feedback? How do we build trust? How do we forgive even when people have taken advantage of us because they saw us as means to an end and not as humans? How do we shed all of the ridiculous expectations that come with being the first or only and recognize that much of that is a trap created for us to fall into – to become mythologized to the point of no longer being human with flaws, interests and ideas?

Writing inspiration/other people’s work that vibez with this one:

- I want to watch this every week honestly. Kathleen Collins is a genius: https://vimeo.com/203379245

- I first heard of power with vs power over in a Brene Brown podcast, but this is a more succinct summary of the description: https://sustainingcommunity.wordpress.com/2019/02/01/4-types-of-power/

- How do I stay aware of my own “Goliath”-ness so that I never fully become them? This speech was at my college gradution on that exact topic: https://www.youtube.com/watch?v=3oMvVtIQuMk

- One of my favorite writers, Chimamanda’s recent post: This is Obscene. I have so many thoughts. Probably could be it’s own post.

- Ralph Waldo Emerson’s quote: “Let me never fall into the vulgar mistake of dreaming that I am persecuted whenever I am contradicted.” I love that this beautiful quote was buried in one of his journal entries.

- “Weary” – Solange

- The Other Black Girl – Honestly I recommend the whole book, but this quote from this interview gets to the heart of why the book resonated so deeply with me: “The traits Nella would need to be a good editor – sensitivity to the world, the ability to feel and react deeply – are the opposite of what she needs to successfully navigate publishing to become an editor. I’m interested in the ways your book discusses compromising your authenticity and numbing yourself for survival.” I think this is true of VC too, the traits necessary to be a good VC require sensitivity to the world so you can feel it all and diagnose what is going on and how to plug into it. Yet VC is also a business. How do you square the two?

- This whole thread on Twitter…