I am so excited to be a part of the Kauffman Fellows Program! I did it for a variety of reasons, which I’ll try to outline here.

First, though, I want to tell you about my biggest pandemic learnings. The answer to why Kauffman starts there.

Pandemic Learnings

The pandemic gave me a lot of time and space to reflect on how I was previously operating in the world and explore how I might design a life that fits me post-pandemic. I realized that I was very reactive, almost constantly, in pre-pandemic life and I wanted to build more intention into my life. After this reflection, I started to explore what I used to do in pre-pandemic life that doesn’t suit me.

The first thing I came up with was networking. I realized I get very serious anxiety around networking in its traditional sense. Attending events, especially nighttime events, was devastating to my sleep. It takes me hours to process events because I am very hypervigilant in large groups, which means that the cost of a nighttime event is a nighttime of sleep.

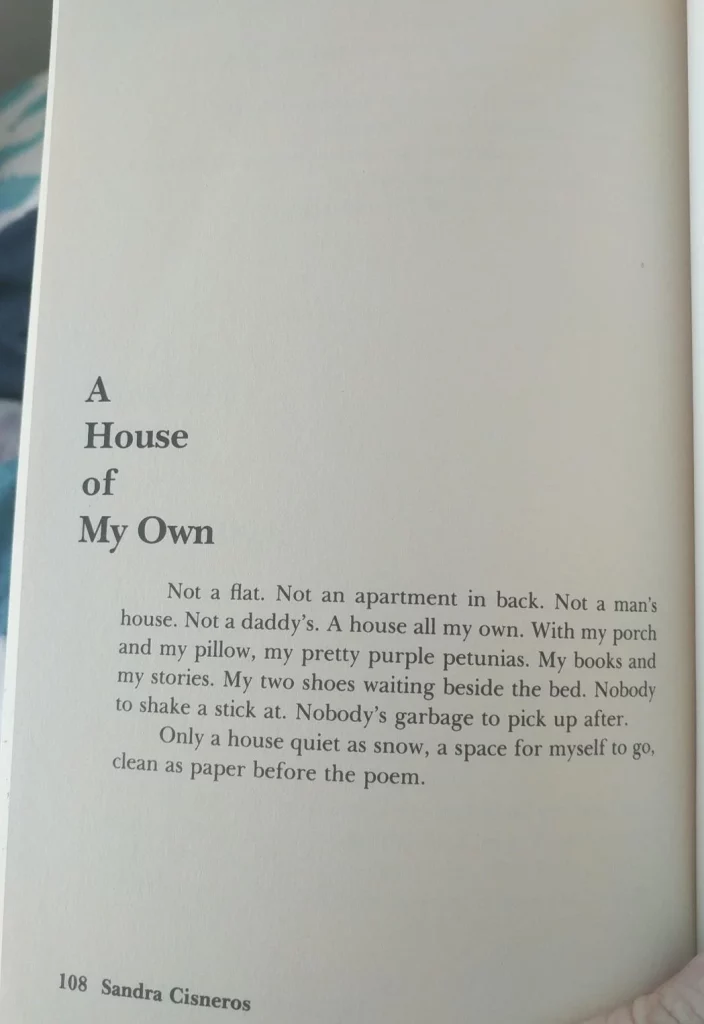

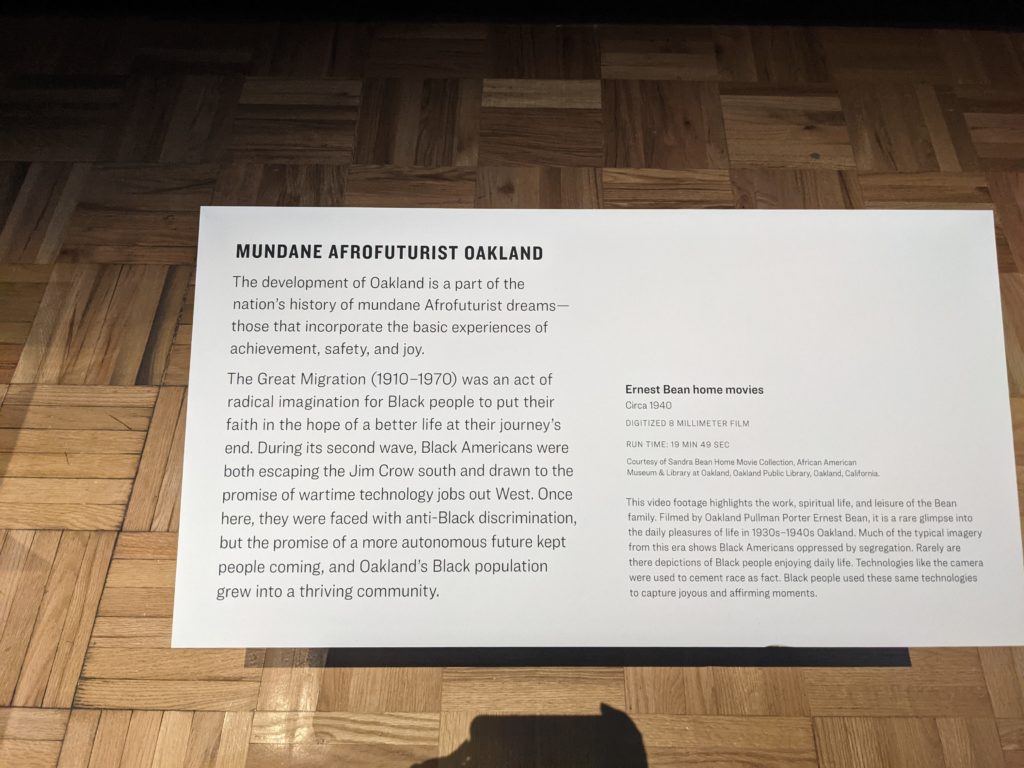

The second thing that came up was my commute/working life in SF. I am based in Oakland. I love Oakland so much!! I love the new friends and communities I have been able to build because of the pandemic-induced WFH situation. I am now more deeply connected to my neighbors, local businesses + city government. I won’t give that up. My ability to live in a neighborhood whose values align so deeply with my own, to have Black neighbors, to have the kids on the street look out for me to see if I’m hanging out on my porch swing… it’s really beautiful. I now know the true opportunity cost of my commute/working life in SF. While Precursor plans to open an office eventually, I don’t expect to be there for more than a few hours on 1-2 days a week and plan to use that time specifically for team building.

There are a few reasons why I think it took me so long to realize these qualities about myself. One of them is that there is a prevailing notion in VC that younger VCs have infinite time and energy because they don’t have children, spouses, etc. This is compared to older VCs who have families and can’t possibly be expected to go to another networking dinner. I fundamentally disagree with that. Young VCs might be caring for aging parents, might be volunteering in their community, might be struggling mentally/emotionally and this expectation that their time is less valuable than older VCs’ time is dangerous.

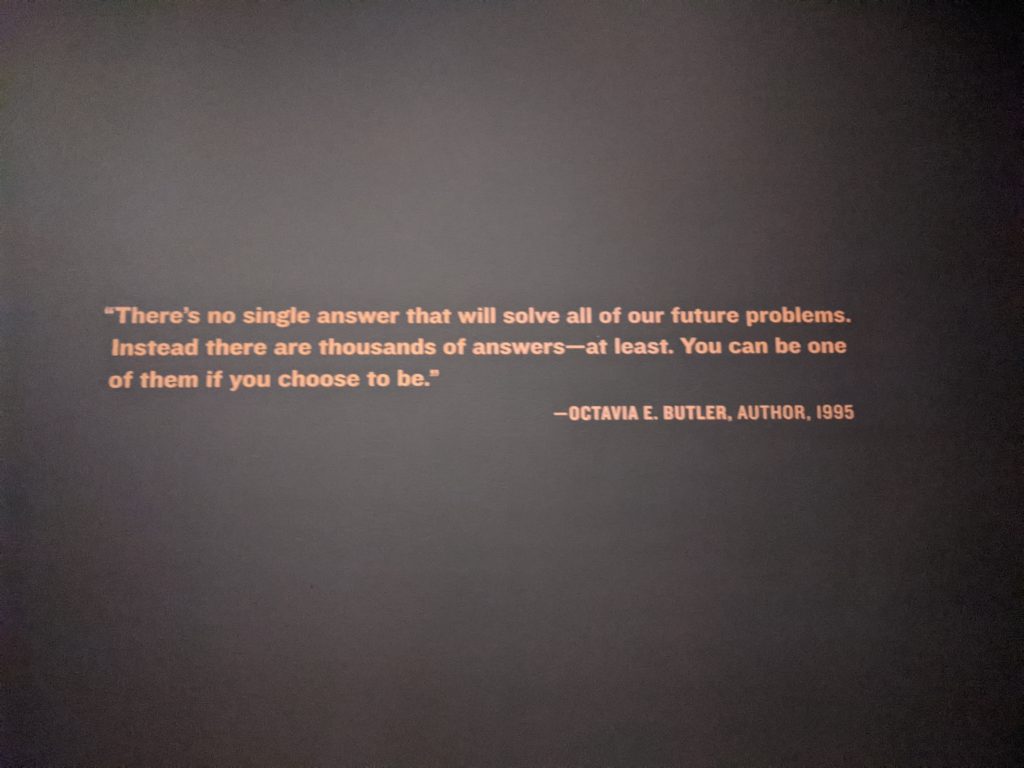

As a result of this reflection, I decided to replace the very transactional nature of many of these coffees and lunches and happy hours with anyone who e-mails me w/ an @vcfirm.com e-mail address with an experience that gives me an opportunity to build relationships with people who are taking the time and effort to really get to know me and who are excited about improving themselves. Which brings me to Kauffman. I am so excited to join this group of folks who are building intentional relationships with each other in a way that is less transactional.

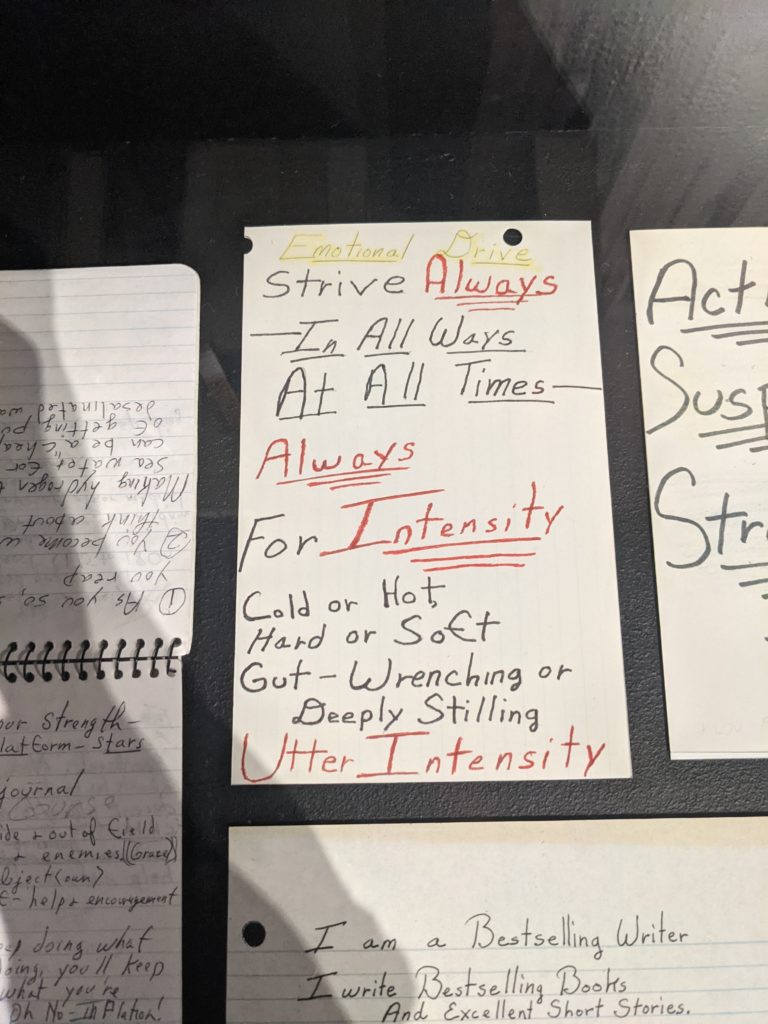

Growth Mindset

Another reason I joined Kauffman, is because while I have a really strong perspective on what types of companies I am passionate about investing in, I know that there are still things I don’t know about this business and myself. I am looking forward to using this space, as a Kauffman Fellow, to be, in many ways, a learner. There is a lot of talk about how Black women need the same opportunity to fail as white guys. I think what we also need to explore is the concept that Black women need the same opportunity to be seen as learners instead of as experts. There is so much research that shows that Black girls in education spaces are adultified. While I’m no longer a child, I think the corollary here is that as a Black woman, I’m often expected to enter new spaces and know all the things all the time – to never slip up. This is a trap. I deserve the space to be seen as a learner and to be given the grace that learners are given. I am grateful to be at a fund that gives me space to learn, make mistakes and grow within the fund. I wish that for all Black women in VC.

The Cost, Though

I want to be honest about how I paid for it. I am not rich, plus Precursor is not a $1B+ fund, so I had some really hard decisions to make.

$80,000 is the cost of Kauffman. Let’s not beat around the bush here: that price tag is really really steep. This leads to an exclusion of folks who might find the experience useful, but just can’t figure out how to make the numbers add up. Many Black people in venture are at less established funds that are unable to foot this large bill on their behalf and they don’t have access to the family wealth to put down this capital on their own. I know this to be true, not just because of the data, but because that is my story. To me, that $80K might as well be $1M. I don’t have $80K and have no way of borrowing it from family. So after I applied and got accepted, I asked for help. I reached out to people and organizations who have been supportive of me over the last 5 years and I was met with such generosity. I was able to get $10K from an 😇, $20K from a sponsor organization and $40K from Kauffman. Precursor paid the remaining $10K.

I am so lucky. I know that. I am brainstorming ways to make this experience more accessible to those who are not as lucky. More updates on that later this year! If you’re interested in collaborating on this and have ideas, let me know! You can reach me at sydney@precursorvc.com.

Thanks for reading! Looking forward to continuing to share more about my experience in the program over the coming months and years!

References and motivation to write this:

- Nick Caldwell’s “Happy to Be Here” YouTube clip