There has been a lot of ink spilled on how to support emerging managers more generally in VC. A lot of it is written by First Republic Bank’s Samir Kaji. I am really grateful for his writing and think it adds a lot of value and context to this conversation!

One thing that I think is missing from this conversation is the discussion on how to support Black Women emerging managers in VC. I think that Minda Harts writes a lot about how to support black women in the work place generally so that should also been used as a preface to this article – if you have not read The Memo by Minda Harts book, stop now and pick it up! It also adds a lot of value to this conversation and is useful context to have before engaging here.

Also for context, I am writing as experience as a Black Woman in Pre-Seed investing. What Black Women in Series A/B/C+ investing need might be different.

As an emerging manager and a Black Woman, I have been thinking really deeply on ways that I have had people show up for me to get to this point and ways that I wish people would have showed up for me. I wanted to write this down to share tips with people who are exploring ways to support other Black Women in VC. The hope is that every Black Woman in VC who comes after me has an easier ride. Because frankly, these past 4+ years have been a rollercoaster!

1. Answer their e-mails or LinkedIn messages – better yet, e-mail them!

One thing that I still have a chip on my shoulder about is the list of people who when I was first starting out in this industry did not respond to my cold e-mails or LinkedIn messages. I also still remember, fondly, those who did respond. One of those folks was Scott Belsky. I cold e-mailed Scott Belsky and he responded with a single line that included “sending my best”. And let me tell you, that was all the encouragement I needed at that moment. I was so bolstered by that because someone who I saw as “powerful and successful” took time to invest in e-mailing me back.

I wish though, when I was first getting started, that more GPs at funds e-mailed me first. I know that it is not every day that a black woman gets hired in VC, and I think it’s important that the greater VC community – including but not limited to the Black VC community – pays attention to, and celebrates those hires. My request is not even that you do something big like “grab a coffee” or “go on a walk” with that new hire. Instead, it is that you share a little bit of encouragement. These can make a world of difference. An e-mail letting folks know that you see them. Letting them know that you are wishing them well. Letting them know that you are grateful they are in this ecosystem. These are the things I hope younger Black Women in VC get from allies.

2. Support the deals they bring to the table

“Leaders should be evaluated by how many leaders they create and not how many followers they have.”— Win K.H (@wintakh) August 12, 2020

One of the pieces of advice I got when I first got into VC is that – succeeding in VC is relatively easy, all you need to do is “find good deals”. That advice really rubbed me the wrong way. Because in VC, who decides what is a “good deal”? As the old saying goes, one person’s trash is another man’s treasure. I think it is true especially in VC. And in early-stage VC, whoever has the purse strings gets to be the final say on whether or not that is a “good deal”. Because if folks have uniformly agreed that a deal is “bad”, then more often than not, the company does not get access to the capital they need to prove these folks wrong.

So my advice to people who have the purse strings is, critically evaluate what you think is a “good deal” vs. a “bad deal”. For many, I assume that part of the calculus of whether or not the deal you have been presented with is good vs. bad is whether or not you trust the person who has presented you the deal. Why do you trust this person’s opinion so highly? Is it useful to trust this person’s opinion so much more than others’ opinion? Especially on a company that is building a future that none of us can predict?

I think once people critically examine why they green light some deals over others, the bias will start to expose itself.

How can you offer the same benefit of the doubt to people outside of your “circle”? I think one way is to trust that they are bringing some unique insight to their deal that you are not capable of having because of your differing backgrounds. Once you acknowledge their insight, put capital behind it. Let their insights guide deals that you wouldn’t have otherwise invested in and see how they do.

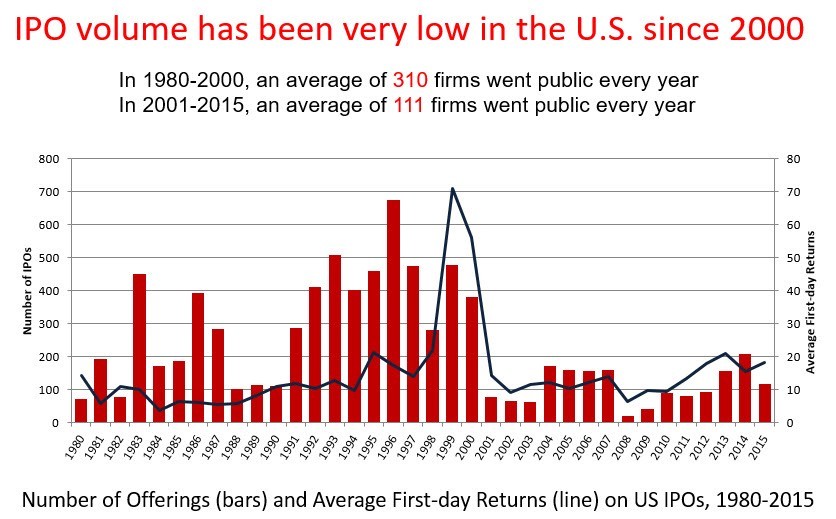

When reflecting on your carrier as an ally, I hope that one of the things you factor in is not how many IPOs or shots on goal you achieved, but how many GPs have you created. How many ideas have you greenlit from URM communities? How much power have you given away in order to create a more equitable (and honestly more interesting!) world?

3. Sponsor their promotions

Over the past four years, I have had the privilege of watching more black women enter venture. I started tracking the growth of this community in 2017 here. One of the things that has been really amazing to watch is the promotion and growth that I’ve seen folks go through from Analyst to Principal. The thing that has been missing though, is the promotion to GP. In almost every case, Black women have only received a GP title if they have started their own funds. This is unsustainable. Partly because, given the wealth inequality in the US, Black women generally have 10x less capital themselves and generally less access to capital than their white male peers.

So why have I yet to see one large VC firm sponsor a black woman’s promotion to a GP? This is unsettling and worrisome to me. I am looking forward to watching this change happen sooner rather than later. A great example of what this could look like is what Jesse at Flybridge built with Lolita Taub. I think it’s such an amazing example of what sponsorship looks like and how it can leverage the skillsets of both parties to create something were 1+1=10.